From the Kindle reader that made the “ink screen” famous, to the electronic price tags that kept the industry alive during the industry downturn, the development of electronic paper display technology in terminal applications did not happen overnight. It is precisely because of the foundation laid by the two major applications of readers and electronic price tags in the early stage that e-paper display technology has been widely used in recent years, including e-paper office notebooks, study notebooks, monitors, table cards, name badges, digital signage, word cards (machine), bus stop signs, luggage cards, smart handles and a series of products have come out one after another. Some terminal products have stepped up market exploration, while some terminal products have been widely recognized by consumers once launched and have been commercialized quickly.

We believes that e-paper is forming a “2+1+1+2″ smart scenario layout, that is, two “basic application scenarios”: smart retail and smart office; the one “potential application scenarios” is smart education, the one “development pilot scenarios” is smart transportation, and the two “scenarios to be developed” are smart government affairs and smart healthcare.

The scenario development trend of e-paper display technology can be summarized as: “widening of horizontal fields and deepening of vertical products”. From the earliest retail and office scenarios, we will gradually expand horizontally. Among them, related products in the education field will achieve explosive growth in 2023 after being market verified in 2022, and will be one of the most potential application areas in the next few years. ; The application pilot of transportation scenarios continues to advance, and the number of successful cases continues to increase, including the development of e-paper bus stop signs and information boards in Europe, the development of e-paper smart handles in China, etc. Government affairs and medical scenarios have also transformed from scratch. Although the market size is almost negligible at the moment, related applications have gradually penetrated into the front line of the market through trials.

At the same time, the application of terminal products in major mainstream scenarios is also deepening at the vertical level. Taking the retail scenario as an example, it has been upgraded from simple small-sized electronic price tags to medium-sized ones, and is currently further developing the large-sized retail digital signage market. , other application scenarios also show different degrees of product deepening trends.

The application of e-paper in six major scenarios will help the overall development of the industry, which is mainly reflected in the following: first, as the application scenarios continue to expand, people in different fields and different industries will increase their understanding of e-paper display technology; Second, in the process of expanding e-paper into horizontal scenarios and vertical products, it will effectively expand the market size of e-paper display technology and force the growth of product quality and performance; third, product circulation will move in the direction of high added value. Migration will ultimately improve the overall profit level of the industry and the quality of business operations.

As the first part of a series of outlooks, this article will focus on analyzing two “basic application scenarios”: smart retail and smart office.

Smart retail: from small sizes to medium and large sizes, from single products to multiple products

E-paper price tags have developed rapidly in recent years, gradually replacing readers and becoming the basic product in the field of e-paper, and also shaping the dominant position of smart retail in e-paper application scenarios.

At present, its main market areas are concentrated in developed countries in Europe. The main driving force for its development is the growth of the retail industry, which corresponds to the decline in labor participation rates in developed countries.

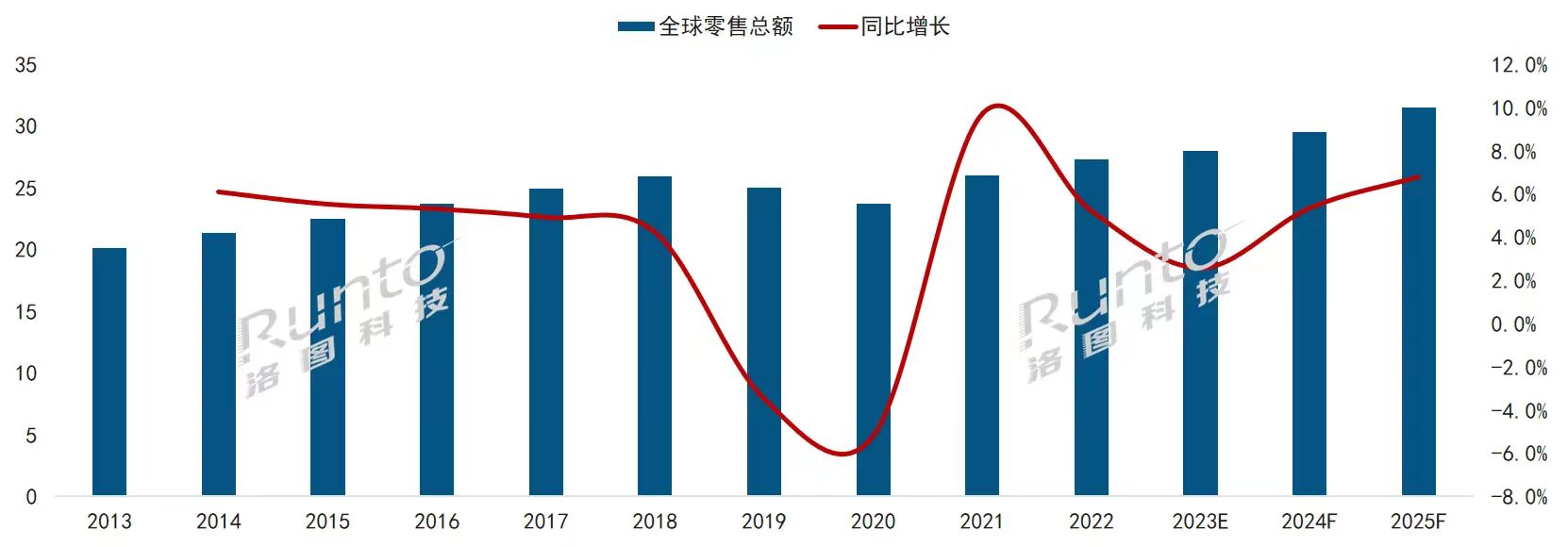

First, total global retail sales are expanding over the long term and will exceed $30 trillion by 2025. The penetration rate of global digital stores is currently less than 1%, but the number has nearly doubled compared to 2016.

2013-2025F Global retail sales and growth rate

unit: trillion US dollars, %

Corresponding to the rapid growth of the retail industry is the decline in the labor participation rate. According to United Nations statistics, the labor participation rate in Europe has dropped by 2.6 percentage points compared with 2015, while in North America it has dropped by 2.2 percentage points. Under the interaction between the rapid increase in labor demand and the decrease in labor participation rate in the European and American retail industries, retail digitalization has become an urgent problem to be solved. This is why electronic paper price tags have great development opportunities in Europe and the United States.

As the population ages in the Chinese market, the scale of labor supply is also declining, and the labor participation rate dropped by 3.3 percentage points compared with 2015. Digital products such as electronic price tags can effectively replace human investment and improve store operation efficiency. Therefore, China’s electronic price tag market also has huge medium and long-term development space.

According to RUNTO’s forecast, global electronic paper price tag shipments will reach 300 million pieces in 2024, a year-on-year increase of approximately 30%.

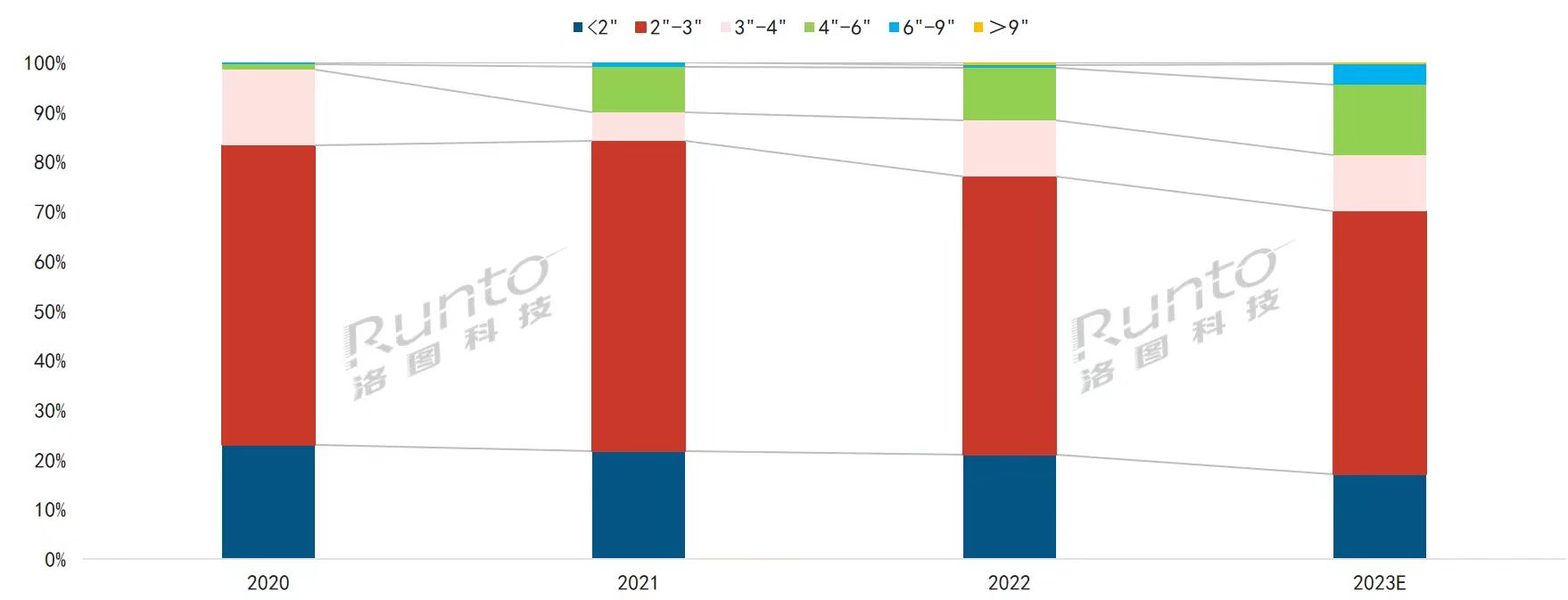

In addition, the product form of electronic paper price tags is migrating to medium and large sizes. According to data from RUNTO, the proportion of 4-inch and above products has increased from 1.4% in 2020 to 18.6% in 2023. Among them, 4-6-inch electronic paper price tag products have grown the fastest and will gradually become the market leader in the future. mainstream.

2013-2023E Global e-paper price tag size structure

unit: %

Small-sized price tags are limited by space and can only display basic product information, while medium-sized price tags can not only display product names and prices, but also relevant promotional information.

Large-sized e-paper retail digital signs can even display product information for the entire store, including basic introduction, price, promotion and other aspects, and at the same time realize one-click price changes and modifications for the entire store’s products.

At present, many European countries have introduced regulations that limit the display time of digital billboards, and continue to suppress energy-intensive billboard products. E-paper billboards are relatively able to meet low-carbon requirements and can provide long-term information release services. 42-inch color e-paper billboard products are already in use, and will be followed by larger-sized products such as 55-inch, 65-inch, 75-inch, and 85-inch.

Smart office: from one-way information display to intelligent interaction

E-paper products have already appeared in the office field, such as table cards, name tags, monitors, etc.

Since the basic functions of table cards and name tags are equivalent to the size of price tags, the modules can be universal to a large extent. Therefore, during the period of rapid development of price tags, related products have been launched and used to a certain extent. However, its market size is limited due to factors such as high costs and low corporate awareness of it.

Another product is an electronic paper display, which can be connected to a computer and used alone as a display. It is characterized by being easy on the eyes for a long time and is very friendly to writers, programmers and artists. However, because the consumers it faces are relatively small. However, it still does not have advantages in terms of market penetration rate and cost-effectiveness, and consumers are still in the stage of trying new products and trying them out.

According to current trends, China’s e-paper display market size will reach 5,000 units in 2023, and it is expected that China’s e-paper display market size will reach 26,000 units in 2027. However, e-paper display products still have certain uncertainties. The user range is small, and it is very difficult to reach and educate the market. It will be difficult to achieve large-scale release in the office field in the future.

The application of e-paper in the office field has received widespread attention in 2022. After Kindle announced its withdrawal from China, major brand manufacturers have deployed the e-paper tablet market across borders and industries, and these manufacturers generally do not stick to traditional reading scenarios. It pays more attention to the office field and seizes the tablet market with larger office notebooks.

Post time: Dec-26-2023